Cra Work From Home 2024 – No receipts or proof of your expenditures was needed, and, most significantly, no CRA form was needed from your employer to certify your work-from-home arrangement. But for the 2023 tax return, which . The flat-rate home-office expense deduction is no longer available for 2023. But eligible employees who work from home can still claim a deduction. .

Cra Work From Home 2024

Source : www.ziprecruiter.comNew CRA rules around work from home make it harder to claim

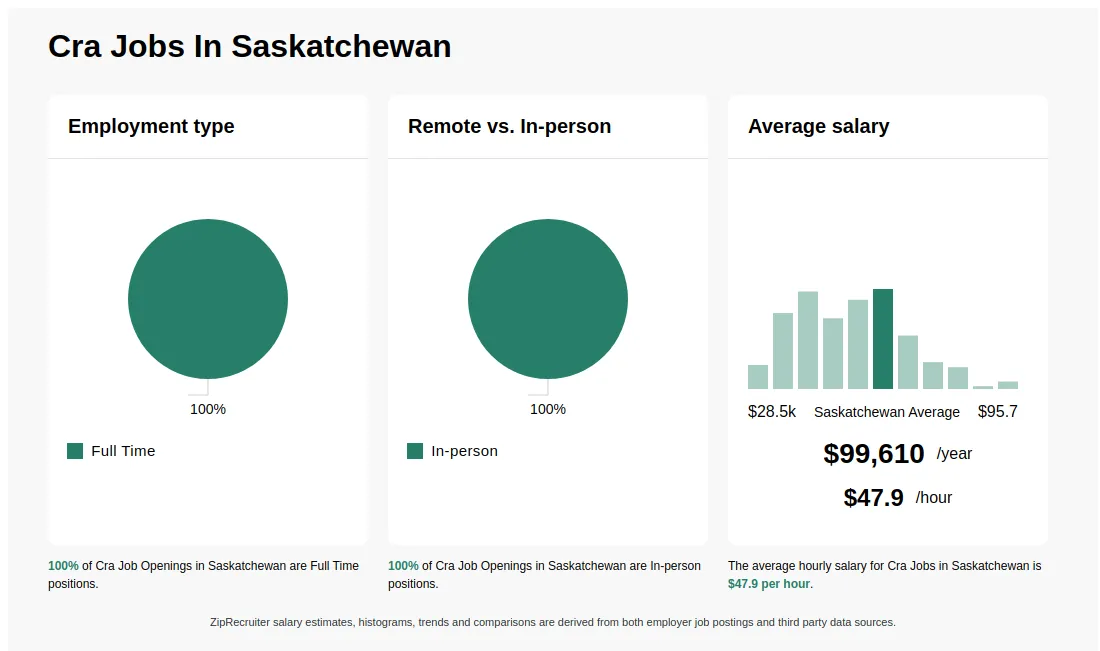

Source : financialpost.com$31 $72/hr Cra Jobs in Saskatchewan (NOW HIRING) Feb 2024

Source : www.ziprecruiter.comNew CRA rules around work from home make it harder to claim

Source : financialpost.com$29 $58/hr Cra Jobs in Murrieta, CA (NOW HIRING) Feb 2024

Source : www.ziprecruiter.comEY Tax Alert 2024 no 05 CRA provides additional guidance on home

Source : www.ey.com$13 $22/hr Cra Customer Service Jobs in Denton, TX

Source : www.ziprecruiter.comNew CRA rules around work from home make it harder to claim

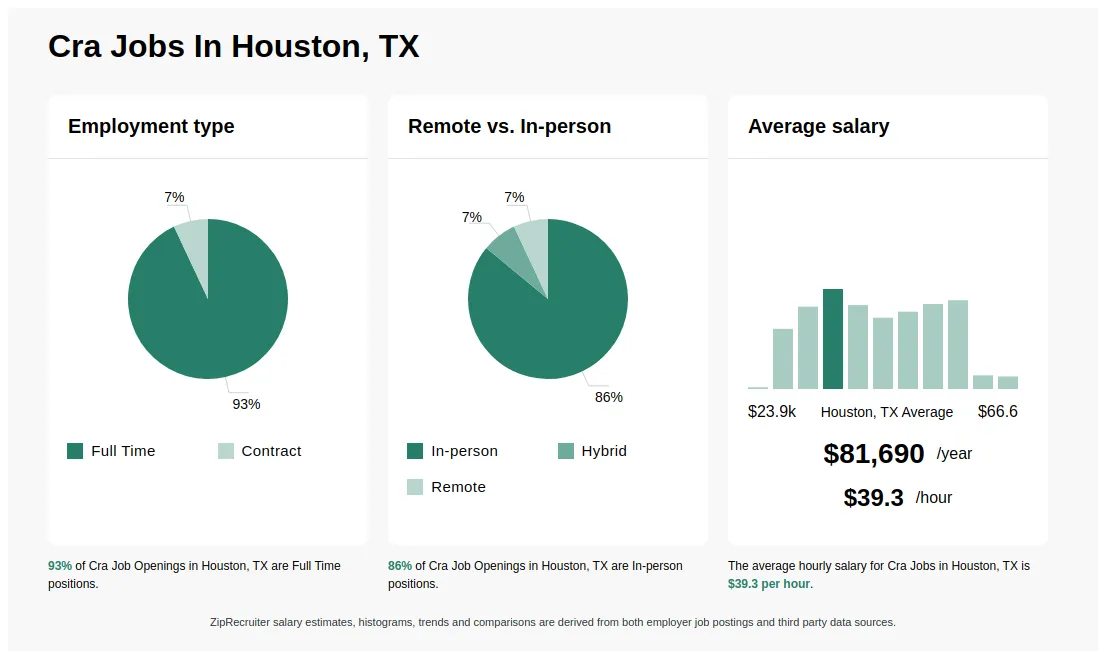

Source : financialpost.com$27 $55/hr Cra Jobs in Houston, TX (NOW HIRING) Feb 2024

Source : www.ziprecruiter.comDeLand Craft Show

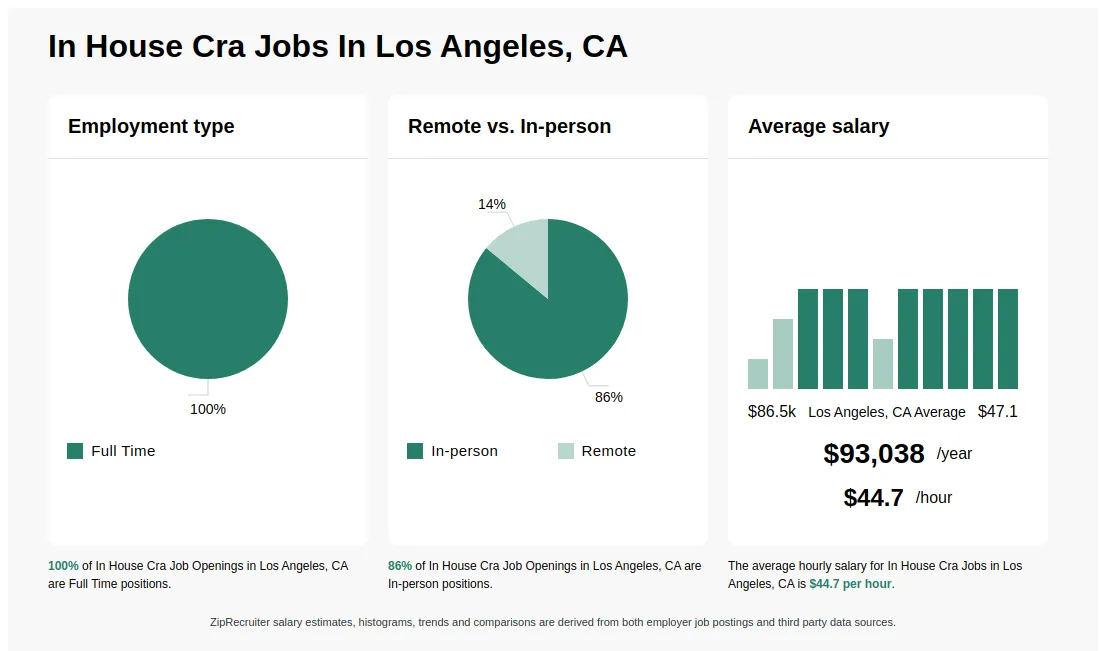

Source : www.facebook.comCra Work From Home 2024 $43 $46/hr In House Cra Jobs in Los Angeles, CA (NOW HIRING): The work-at-home tax deduction is available during COVID-19 or for the income year 2020 only. To make sure many can claim the tax deduction, the CRA simplified the claiming process. Eligible . There is also a link between working from home and higher productivity. The researchers say this suggests that, for every extra day an employee works outside the office, their productivity rises to .

]]>